Thanks to advances in next-generation sequencing (NGS) technology, genomic data is being generated on an unprecedented scale. Improvements in cloud computing resources have allowed the raw data to be processed and stored with ever-increasing efficiency. However, analyzing this data and gaining insights from it is still very challenging and limited to a select few due to technology restrictions. This results in reduced efficiency for R&D teams, longer times to market for assay manufacturers, and increased turnaround times in clinical settings.

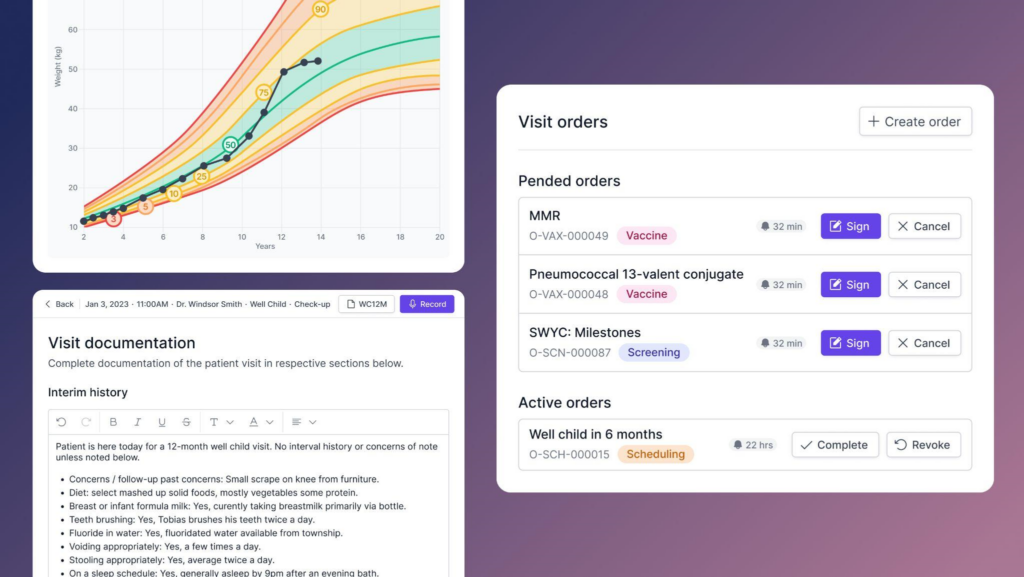

Basepair, a software-as-a-service (SaaS) platform, democratizes access to and the analysis and interpretation of genomic data. Basepair allows organizations to connect to and leverage the compute and storage resources in their own cloud account, allowing them to optimize their resources and realize greater business value. This allows them to remain connected to the other analytical capabilities offered by their cloud provider while benefiting from economies of scale by running everything through one account. This enables the end users with the appropriate domain expertise to run the same workflows in a controlled setting and use the inbuilt visualization tools and reports to make sense of the data.

Z21 Ventures is pleased to announce our strategic investment in Basepair. This investment reflects our commitment to supporting innovative solutions and purposeful companies. Basepair aligns seamlessly with our vision, providing an innovative solution that makes bioinformatics easier, faster, and cost-effective.

“z21 is more than just an investor; it’s a team of builders and operators. From the start, the investment process was efficient and well-managed. They have connected us with top-tier investors and talent in Silicon Valley. Behind the scenes, they actively help improve the business from the ground up. z21 should be the top choice for any founder.” – Amit U Sinha | Founder & CEO of Basepair

We are thrilled about the investment and the upcoming collaboration with Basepair and the vibrant Z21 community. We eagerly anticipate the opportunity to work closely with the Basepair team, leveraging our collective expertise to propel them toward even greater heights in the genomics industry.